When the Ohio General Assembly passed and Governor DeWine signed HB 33, Ohio’s biennial operating budget earlier this year, they did more than enact a current-expense spending plan for the state. They also created a Joint Committee on Property Tax Review and Reform (”Property Tax Committee”). {The language creating the Property Tax Committee can be viewed on page 6,185 of the ‘as enrolled’ version of HB 33: https://www.legislature.ohio.gov/legislation/135/hb33/documents .}

Legislators from both sides of the aisle voiced concerns throughout budget hearings about increasing property valuations having the potential to cause significant increases to property tax bills across Ohio this year, and into the near future. As State Representative Dan Troy said during the Ohio House’s passage of the budget bill, “One of the most complex and least understood public policy areas in Ohio is our local property tax system…it is the belief of many that a significant comprehensive and educational review of the system is overdue.”

The stated goal of the Property Tax Committee is to produce a report making recommendations on reforms to Ohio’s property tax law no later than December 31, 2024. The committee is instructed to review all aspects of Ohio’s property tax law including levies, exemptions, and local political subdivision budgeting. Notably, as the scope of the committee is not limited to any particular portion of the state’s property taxation system, the committee hearings could encompass all of the areas which relate to property taxes as noted in the Ohio Department of Taxation’s Annual Report (https://tax.ohio.gov/static/communications/publications/annual_reports/2022annualreport.pdf ).

Those areas are: real property taxes, tangible personal property taxes (TPP) on public utilities, and real property taxes on manufactured homes, as well as any statutory replacement funds, credits, exemptions, reduction factors, and any special provisions like the Current Agricultural Use Value (CAUV) which benefit Ohio’s farmers and Ohio’s agricultural industry by providing tax relief for certain property used in agriculture.

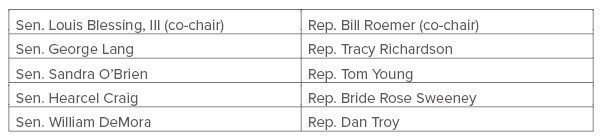

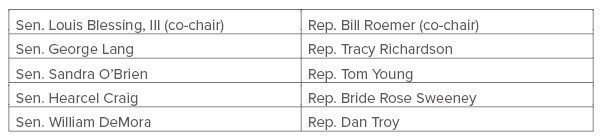

The Property Tax Committee is comprised of ten legislators – five from each chamber.

A schedule for hearings has not yet been released. If you would like to participate in the Property Tax Committee process, please contact Brian Perera, Steve Hall or any of our ZHF professionals.