The Ohio Department of Taxation has released new Employer Withholding Tables to be used for payroll periods that end on or after November 1, 2023. These tables put into effect the reduced individual income tax rates enacted by Am. Sub. House Bill 33 (“HB 33”), the biennial operating budget.

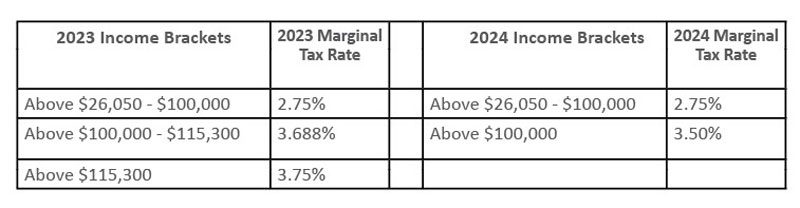

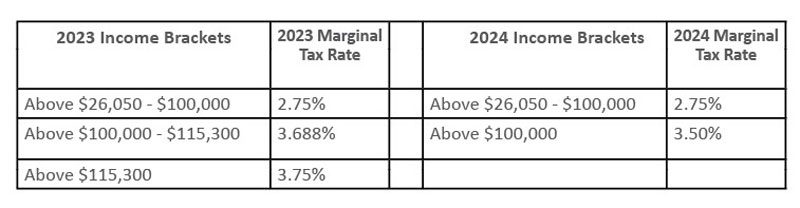

As most readers will recall, HB 33 reduced the number of income tax brackets and cut the rates of tax for tax year 2023, with a further reduction and cut for 2024 and beyond. The brackets and marginal tax rates after these changes are reflected in the following chart:

The new withholding tables account for the number of exemptions claimed by an employee taxpayer, and are to be used by payroll departments or providers in determining the Ohio withholding to be applied to the employee’s payroll. The tables are available from the Ohio Department of Taxation here.

If you have questions about Ohio payroll taxes, please contact any of our ZHF professionals.