Governor DeWine signed the Ohio Biennial Budget Bill, Am. Sub. H.B. 33 (the “Budget Bill” or “Bill”) into law on July 3, 2023, and announced his vetoes. The bill includes many significant policy changes while still funding many of Governor DeWine’s priorities for the coming two fiscal years. This SALT Buzz will focus on the tax and economic development changes that have been enacted and provide some insight into the new provisions.

The Governor’s budget proposal was introduced on February 15, 2023, and did not include any significant tax cuts. In April, the Ohio House added significant income tax cuts and other tax provisions. The Senate stepped up with still more tax cuts, adding significantly to the House’s income tax proposal, as well as cutting the CAT for all taxpayers and providing an enhanced sales tax holiday. The Conference Committee issued its report on June 30, 2023, generally adopting and improving upon the Senate’s tax changes. Earlier, the General Assembly had passed an interim budget provision folded into the Workers’ Compensation Budget, thereby giving the Governor a few extra days to consider his vetoes.

Individual Income Tax

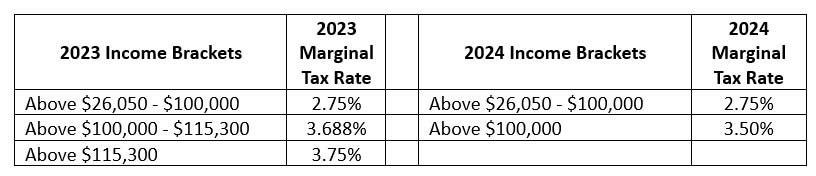

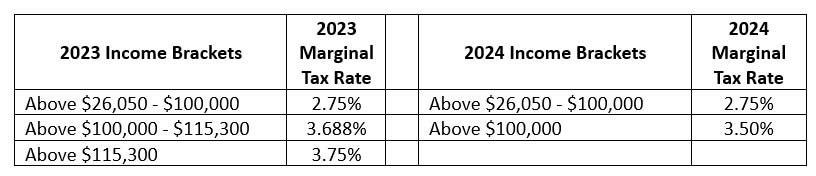

Income Tax Cut. One of the headline provisions is the further flattening of the individual income tax. The Bill phases in several changes to Ohio’s individual income tax rate on non-business income, and reduces the number of brackets from five to just two. R.C. 5747.02. The following chart illustrates the changes.

Current law’s required indexing of income tax brackets for inflation was suspended through a temporary law provision. The Senate and Conference Committee had included a provision suspending this indexing in both permanent and temporary law. Although the Governor vetoed the permanent law provision, the indexing is still suspended for 2 years.

ZHF Observation: Beginning with Ohio’s massive tax reforms in 2005, Ohio has been steadily reducing its income tax rates and number of tax brackets in an effort to make Ohio more competitive. The highest marginal rate in 2004 was 7.5%, with nine tax brackets being in place. By 2024, with a top rate of just 3.50% on nonbusiness income and only two brackets, Ohio will have reduced its income tax rate by 53% over the last 20 years. And, business income continues to only be taxed at 3% for amounts over $125,000 if filing single and $250,000 if filing jointly. Well done Governor DeWine and the General Assembly!

Withholding Table Changes. The tax withholding tables should change to accommodate the new rates and brackets; however, that is up to the Tax Commissioner to decide by rule. The Governor vetoed a provision that would have required the Tax Commissioner to adjust the withholding tables and paid for that adjustment with the investment earnings of the state’s Rainy Day Fund.

Reduced Filing Frequency of Withholding Reconciliation Tax Returns. Employers who withhold and remit employee income taxes on a partial weekly basis will now file annual reconciliation returns instead of filing quarterly reconciliation returns. This change is effective for 2024. R.C. 5747.07 & 5747.072.

Resident Credit Changes for Pass-Through Entity Owners. The Bill makes changes to the Ohio resident credit by permitting taxes paid by a pass-through entity (“PTE”) to other states or the District of Columbia to avoid the federal SALT Cap limit, as well as taxes paid to other states on a composite return, to qualify for purposes of calculating the owners’ resident tax credit. To qualify, however, the owners must add back to their Ohio adjusted gross income the amount of non-Ohio state and local taxes paid by the PTE that were deducted for federal tax purposes. The provision applies to taxable years beginning on or after January 1, 2023, but taxpayers may elect to apply the provision to their 2022 tax return, either on their original Ohio tax return or an amended tax return. R.C. 5747.05.

ZHF Observation: Since the 1990s, Ohio law has not permitted state and local taxes imposed on a PTE to be included in the resident credit calculation if the taxes were deducted for federal and Ohio tax purposes. As a result, the purpose of this provision was to ensure Ohio owners of PTEs were not disadvantaged in relation to non-Ohio PTE owners, especially in light of the proliferation of SALT Cap Workaround legislation recently adopted by many states.

Tax-Favored Home Purchasing Savings Account/Linked Deposits Program. The Bill authorizes a new income tax deduction beginning in 2024 to incentivize and support home ownership. The deduction is equal to the amounts contributed to a homeownership savings linked deposits account by a taxpayer. The deduction is limited to $5,000 per year for single taxpayers and $10,000 for joint filers, with a lifetime maximum of $25,000 per contributor, per account. In addition to the contributions, a deduction is also allowed for the account’s interest earnings and on any employer contributions to the account. Any amounts that are ultimately withdrawn from the account and not used to purchase a primary residence for the account holder must be added to the account holder’s taxable income in the year withdrawn. R.C. 5747.84.

Train Derailment Payments Exempt. A new deduction is created for any government or any railroad company payments, including for lost business, received by a taxpayer as a result of the East Palestine train derailment. The deduction is available for taxable years beginning on or after January 1, 2023. R.C. 5747.01(A)(39).

Scholarship Granting Organization Donation Timing. Under current law, any single taxpayer that contributes up to $750 ($1,500 for joint filers) during the taxable year to a qualifying scholarship granting organization (SGO) is granted an equivalent income tax credit. The Budget Bill now provides that a taxpayer may elect to claim an income tax credit for a taxable year for any contribution made to an SGO until the due date of the Ohio tax return for such taxable year (generally the following April 15th). R.C. 5747.73.

ZHF Observation: Although an individual taxpayer may now make a contribution by April 15th and still have it qualify for the SGO tax credit for their prior year Ohio return, this change will not accelerate the deductibility of the contribution for federal income tax purposes—a taxpayer that itemizes for federal tax purposes will only be able to deduct the contribution in the year the contribution was actually made to the SGO.

Nonchartered, Nonpublic School Tuition Credit. Current law provides a nonrefundable income tax credit for taxpayers with one or more dependents who attend a nonchartered, nonpublic school. The nonrefundable income tax credit is measured by the tuition paid to the nonchartered, nonpublic school and is limited to single and joint taxpayers with total income not exceeding $100,000. Taxpayers with incomes below $50,000 are eligible for a $500 credit, while those taxpayers with income of $50,000 to $100,000 are eligible for a $1,000 credit. The Budget Bill removes the $100,000 income cap and increases the amount of the credit that is available—for taxpayers with income below $50,000, the credit is increased to $1,000 and for taxpayers with income of $50,000 or more, the credit is increased to $1,500. R.C. 5747.75.

Income Tax Reduction Fund Eliminated. Ohio has had an Income Tax Reduction Fund (“ITRF”) since 1996. When tax revenues exceeded certain spending levels, the excess revenues were automatically deposited into the ITRF, and the amounts were used to temporarily lower the income tax rates for the following tax season. The last time this fund was used was in 2000. Since that time, Ohio budget makers have avoided funding the ITRF in favor of permanent income tax cuts and other tax reductions.

Sales and Use Tax

Expanded Annual Sales Tax Holiday. Current law provides for a three-day sales tax holiday before each new school year for purchases of clothing up to $75 per item, and school supplies or instructional material up to $20 per item. The Budget Bill as passed by the General Assembly provided for an expanded sales tax holiday of 14 days, beginning on August 1, 2024. However, the Governor vetoed some of this language to eliminate the requirement that the holiday be 14 days. Instead, the Tax Commissioner and OBM Director will decide how long the holiday will be. If held, the expanded sales tax holiday will apply to purchases of any item of tangible personal property with a purchase price of $500 or less, with the following exceptions: the holiday will not apply to the purchase of motor vehicles, a titled watercraft or outboard motor, alcohol, tobacco, vapor products or any products containing marijuana. R.C. 5739.01.

After 2024, similarly expanded annual sales tax holidays may also be held, but will be contingent on the accumulation of at least $50 million in the new Expanded Sales Tax Holiday Fund. This fund will collect money from any surplus that builds up in the General Revenue Fund (“GRF”) after the annual target is met for the Budget Stabilization Fund (“BSF”, a.k.a. Rainy Day Fund). R.C. 131.43 and 131.44. In essence, if tax revenues are sufficient to meet the target, the state will put any excess into the new Expanded Sales Tax Holiday Fund, which will cover the cost of expanding the annual new school year sales tax holiday during the following fiscal year. R.C. 5739.41.

Exemption for Baby Products. Baby products are now exempt from the sales tax, including diapers, creams, cribs, car seats, and strollers. R.C. 5739.02.

Karvo Decision Codified. The Budget Bill includes a provision exempting sales or rentals to government agencies of construction material and services for traffic control and drainage improvement. This provision codifies the holding in Karvo Paving Co. v. Testa, 2019-Ohio-3974.

ZHF Observation: The provision, drafted by ZHF, should have been unnecessary. However, ODT refused to apply the decision to local government construction projects even though identical contract terms were used at the local level as those used by Ohio in Karvo. Without this affirming legislation, it would be years before a new court case made a similar conclusion for local construction contracts, which could have hampered important new local projects. Unfortunately, Governor DeWine deleted uncodified language providing that these changes were clarifying and applied to prior tax periods. As a result, ODT may become more entrenched with its opposition to Karvo’s holding for prior tax periods and taxpayers will be forced to litigate to defend their position.

Fireworks Fee. Beginning October 1, 2023, the 4% fireworks fee imposed by R.C. 3743.22 on the sale of consumer grade fireworks is exempt from the sales and use tax. To be exempt, the fee must be separately stated on the invoice, bill of sale, or similar document given to the retail customer. R.C. 5739.02(B)(65).

Commercial Activity Tax (“CAT”)

Exclusion Increased to $3 million in 2024 and $6 million in 2025. The Budget Bill dramatically reduces the number of CAT taxpayers by providing that the first $3 million of a business’ taxable gross receipts are excluded from the CAT calculation for calendar year 2024. This exclusion amount is increased to $6 million in 2025 and after. The exclusion is no longer phased out, which means taxpayers of all sizes benefit from the exclusion and will have a reduction of their CAT liability. R.C. 5751.01(R).

While the Budget Bill contained language that would have prevented taxpayers below the exclusion threshold from needing to file CAT returns, Governor DeWine vetoed that language. So, although the new exclusion will eliminate CAT liability for nearly 85% of all previous CAT filers (principally small businesses), those small business may still be required to file a quarterly CAT return. In fact, for businesses that had less than $1 million of taxable gross receipts, they may now have to annually file three more tax returns than they were required to file under prior law—even though they will have zero liability.

ZHF Observation: Ohio cannot seem to get away from requiring businesses to spend more money filing tax returns than the tax which is actually due. Such filings for many businesses already include monthly and quarterly sales tax returns showing zero tax liability, use tax returns showing zero tax liability, and municipal net profit tax returns. Now, we may have to add the CAT to this list of zero returns—where the cost of preparation is more than the tax. Hopefully, ODT will figure out a better way to avoid the needless cost of preparing and filing such returns.

Some History. As a way to protect small businesses from the burden of the new CAT, the original law provided an exclusion of the first $1 million from taxation, which applied to all sizes of taxpayers (all taxpayers owed the minimum CAT). Under the Kasich Administration, the $1 million exclusion was phased out as a taxpayer’s gross receipts grew from $2 million to $4 million, effectively eliminating the exclusion for larger taxpayers with gross receipts exceeding $4 million. These changes increased the CAT on both small and large businesses. The Budget Bill’s language brings back the concept of excluding the first fruits of a business from the CAT and eliminating CAT compliance costs for Ohio’s small businesses.

ZHF Observation: The elimination of many small businesses from the CAT rolls was favored by a coalition of major business associations, including those representing very large taxpayers. The reason for this support was to ensure the longevity of the CAT, which has come under attack from various policy makers, some of whom have favored “putting the CAT down” permanently. It’s hard to blame policy makers for such efforts when small business constituents provide a constant barrage of complaints about the CAT. While the CAT has issues, it has been accepted by most large Ohio businesses, which have actively protected it since it’s birth in 2005. By eliminating small business from the CAT rolls, it is believed the CAT becomes more sustainable in the long run.

The Governor also vetoed the proposed inflation adjustment to the $6 million exclusion amount that would have begun in 2026.

Minimum Tax Eliminated. The Budget Bill eliminates the CAT’s minimum tax. Former R.C. 5751.03(B).

Calendar Year Filings Eliminated. The annual CAT return which is usually due May 10th of each year for calendar year taxpayers (those with less than $1 million of taxable gross receipts) has been eliminated. But, as discussed above, these taxpayers may be required to file four quarterly zero returns each year. R.C. 5751.05 and 5751.051.

Qualified Research Expenditure Tax Credit. The Budget Bill makes some changes to the Qualified Research Expenditure (“QRE”) Credit, also commonly known as the Research and Development (or “R&D”) Credit:

- When the credit is claimed by a group of related taxpayers, such as a consolidated elected or combined taxpayer group under the CAT, or a Financial Institution group under the FIT, the Budget Bill requires the credit now be calculated on a member-by-member basis. Moreover, expenses of a given member may be included in the aggregate credit only if that entity is a member of the group on December 31 of the year in which the QREs are incurred.

- A taxpayer claiming the QRE credit will now be required to maintain records relating to the QREs used in calculating the credit for four years after the later of the return due date or actual date of filing. These records include the year for which the credit was claimed and the three preceding years, which are a part of the base calculation for the credit.

- ODT may now audit a representative sample of the taxpayer’s QREs to verify that the taxpayer has computed its credit correctly. ODT is required to make a good faith effort to reach agreement with the taxpayer on a representative sample but may proceed with a sample even if such an agreement is not reached. R.C. 5726.56 (FIT) & 5751.51 (CAT).

Broadband Grants Excluded from CAT. An exclusion from taxable gross receipt is provided for any government grants or debts forgiven for the purpose of providing or expanding broadband service in Ohio. R.C. 5751.01(F)(2)(rr).

CAT Now Goes to State’s GRF. When enacted in 2005, the CAT served as a revenue replacement for elimination of both the tangible personal property tax and the corporation franchise tax. In fact, 70% of CAT revenue was originally designated for primary and secondary education, while the remaining 30% was earmarked for local jurisdictions. The portion of the CAT going to schools and local jurisdictions has been slowly declining and stood at just 15% for FY2023. The Budget Bill now requires that 100% of the CAT is first deposited into the state’s general revenue fund and that allocations be made to local governments as necessary. R.C. 5751.02.

Heating Companies Subjected to CAT. Beginning July 1, 2023, heating companies become subject to the commercial activity tax because they will no longer be subject, as of May 1, 2023, to the public utility excise tax. R.C. 5727.30 and 5751.01.

Fireworks Fee. The 4% fireworks fee imposed by R.C. 3743.22 that is billed to a customer and actually collected on the sale of consumer grade fireworks is excluded from the retailer’s taxable gross receipts. The exclusion applies to tax periods ending after the Budget Bill’s effective date, which is 90 days after the bill is delivered to the Secretary of State’s office, and has yet to be officially determined. R.C. 5751.01(F)(2)(tt).

Municipal Net Profits and Income Tax

Minors Exempted from Municipal Income Tax. Municipalities will no longer be permitted to tax the income of individuals under 18 years of age, for taxable years beginning on or after January 1, 2024. R.C. 718.01.

Alternative Apportionment Available for Businesses with Remote Workers. Businesses with remote employees will be permitted to choose an alternative apportionment formula for tax years ending after 2023. Instead of using the employee’s remote work location, the employer may designate a “reporting location,” which is a location owned or controlled by the employer or the employer’s customer (in the latter case, only as long as the employer is withholding tax on an employee’s wages at that location). Under the election, the employer may situs property, payroll, and sales activities of a qualifying remote employee or owner to the qualifying reporting location rather than the individual’s qualifying remote work location. R.C. 718.021. ZHF will provide more information on how this election will operate in a future SALT Buzz.

ZHF Observation: This language, drafted by ZHF, provides a statutory basis for companies to do what most companies already do for net profits tax purposes—situs the activity of their remote employees to an employer work location rather than the employee’s home. Unfortunately, a provision to apply this election to prior tax years (and which was supported by municipalities) was removed by the General Assembly, putting some businesses at risk.

Also, employers must remember that this provision only applies to the net profits tax and has no impact on the employer’s responsibility to withhold income taxes on the wages of remote employees at their actual work location (such as their home).

Notices Restricted When Tax Extension is in Place. The Budget Bill prohibits a municipal tax administrator, as well as the Ohio Tax Commissioner, from sending inquiries or notices to a taxpayer about a tax year for which a proper filing extension is in place. If a municipality sends a prohibited notice, the municipality (or state, if filing with the Tax Commissioner) must reimburse the taxpayer for reasonable costs incurred in responding to the notice, but limits the cost to up to $150. R.C. 718.05(G)(5).

ZHF Observation: This provision was required because a handful of municipalities made it a habit to request information from taxpayers about a return that was not even due yet (because an extension was in place).

Late Filing Penalties Eliminated for First Time Offenders. Municipalities will no longer be permitted to impose a late filing penalty of $25 per month, up to $150, for a first-time offense. The new rule applies to taxable years ending on or after January 1, 2023. R.C. 708.27(C)(3).

Net Profits Tax Extension Period Extended. The Budget Bill provides that a business receiving a 6-month federal tax extension will now have 7 months from the original due date to file its municipal net profits tax returns. The law becomes effective for tax returns required to be filed for taxable years ending on or after January 1, 2023. R.C. 718.05 & 718.85.

Property Tax

Residential Land Development Property Tax Exemption. The value of unimproved land subdivided for residential development in excess of the most recent sales price of the property is exempted from the real property tax. The exemption is for up to 8 years or until construction begins or the land is sold. However, even with this exemption, CAUV valuation will not be available if the land is no longer used for agricultural purposes.

The exemption does not apply to real property located in a tax increment financing project. R.C. 5709.56.

Qualified Energy Products. The Budget Bill extends the termination of the qualified energy projects property tax exemption from 2025 to the later of the year in which the U.S. Treasury Secretary determines that there has been a 75% reduction in annual greenhouse gas emissions from the production of electricity in the United States, as compared with the 2022 level, or 2029. Limitations are now imposed upon what qualifies as a “full-time equivalent employee” at qualified energy projects and reduces the ratio of required Ohio-domiciled employees to 70% from 80%. The Bill also requires compliance with federal wage and apprenticeship requirements for 20 megawatt or greater clean energy projects. R.C. 5727.25.

Other Taxes

Sports Gaming Tax. The Sports Gaming Tax, which is imposed on sports gaming proprietors, is doubled from 10% to 20% as of July 1, 2023. All sports gaming tax revenue will be used for the support of public and nonpublic education, excluding interscholastic athletics and other extracurricular activities. R.C. 5753.021 and 5753.031(A)(3).

Financial Institutions Tax. The Budget Bill changes the definition of “financial institution” to include “all entities that are consolidated” in the FR Y-9 or call report and specifies that where a holding company is required to file a parent-only FR Y-9, “financial institution” includes the group the institution would include if it were required by the Federal Reserve Board to file a consolidated report. R.C. 5726.01.

Public Utility Excise Tax. As indicated above, beginning with the 2024 tax year, heating companies are exempted from the public utility excise tax and become, as of July 1, 2024, taxpayers under the CAT instead. R.C. 5727.30(E). Heating companies are also required to adjust the rates they charge their customers to account for the net reduction in taxes that will result from the switch from the public utility excise tax to CAT. Uncodified section 757.80 of the Bill.

Fuel Use Tax. Personal liability for unpaid fuel use tax is imposed on individual owners, employees, officers, and trustees who are responsible for reporting and paying the tax. R.C. 5728.16.

Corporation Franchise Tax. The Budget Bill eliminates the requirement to file an amended corporation franchise tax report to show changes resulting from a federal income tax audit. It also disallows the filing of refund applications based on federal adjustments, beginning January 1, 2024. R.C. 5733.031.

Lodging Tax. Soccer Stadium: The Budget Bill allows Hamilton County to levy an additional 1% lodging tax to fund the acquisition, construction, renovation, expansion, maintenance, operation, or promotion by a convention facilities authority, convention and visitor’s bureau, or port authority of a convention, entertainment, or major league soccer team’s sports facility. R. C. 5739.09.

Headquarters Hotel: The Budget Bill also provides language to exempt a “headquarters hotel” from the lodging tax, either entirely or in part. Instead, the amount of exempted tax may be paid by the hotel to fund construction of facilities associated with the headquarters hotel. Also, the exemption shall not apply to a hotel that has not furnished lodging to guests before its designation if the rate or revenue of the lodging tax were to decrease. R.C. 5739.093.

Cigarette Excise Tax. The Budget Bill contained a wide range of changes to the cigarette excise tax, including new uses of the tax. The changes are summarized as follows:

- Support for the Arts: Rescinds the ability of Cuyahoga Count to convert 30 cents of its existing 34.5 cent cigarette tax (benefitting its regional arts and cultural district) from a per-pack flat rate to a varying rate based on wholesale cost of the cigarettes and to levy a new wholesale tax on vapor products. Chapter 5743. However, the Budget Bill also allows Cuyahoga County to continue levying a cents-per-pack tax and removes the 30 cent cap on the amount of tax that can be levied, if the increased rate is approved by voters. R.C. Chapter 5743.

- License Renewal Deadline: The annual license renewal deadline is moved from the 4th Monday in May to June 1st, thereby adding some certainty and clarity to license holders. The extension applies to all current licenses. R.C. 5743.15.

- Bad Debts: The Governor vetoed a provision that would have allowed a wholesale dealer of cigarettes to obtain a refund on bad debts, as well as a provision that would have exempted the holding of vapor products from the tax if those products were to be sold outside the state.

Tax Credits and Economic Development Incentives

Welcome Home Ohio Program. A new economic development incentive is created and allows the Director of Development to issue tax credit certificates to developers and land banks for the lesser of one-third of rehabilitation/construction costs or $90,000, for residential units that will be sold to low income residents. To qualify for the credits, a qualifying developer or land bank must rehabilitate or build residences and sell them to lower income owner-occupants. The credits may be taken against the individual income tax or the financial institutions tax for the taxable year in which the certificate is issued. While the credits are non-refundable, the credits may be carried forward up to five years, and the tax credits may be transferred to others. The program only applies to fiscal years 2024 and 2025 and the total credits are limited to $25 million each fiscal year. R.C. 122.633.

New Low Income Housing Tax Credits. A new nonrefundable tax credit is enacted that piggybacks on the federal low-income housing tax credit (“LIHTC”) for affordable housing projects. The amount of the credit for any single project is limited to the amount necessary, when combined with the federal credit, to ensure financial feasibility of the project. The credit may be applied to the individual income tax, insurance premiums tax or FIT (but not the CAT). The Director of the Governor’s Office of Housing Transformation may reserve the state tax credit for any project that receives a federal LIHTC allocation, is located in Ohio, and begins renting units after July 1, 2023. The credits may not be reserved after June 30, 2027. The amount of these credits may not exceed $100 million in a fiscal year. However, unreserved credits, and recaptured or disallowed credits, may be carried forward to increase the following fiscal year’s cap. Any records that are provided to the Tax Commissioner and OHFA to administer the LIHTC are not public records subject to Ohio’s sunshine laws.

R. C. 175.16.

Single Family Housing Development Tax Credit. A new nonrefundable tax credit is enacted to encourage the development and construction of affordable single-family housing. The credit for any single project is limited to the amount by which the fair market value of the project’s home exceeds the project’s development costs. Local governments and economic development entities must apply for the credits, but are then allowed to allocate the credit to project investors. The Director of the Governor’s Office of Housing Transformation may reserve a state tax credit for any project in Ohio that may qualify for the credit, as long as the project meets the affordability qualifications of the Ohio Housing Finance Agency. However, no state credits may be reserved after June 30, 2027. The amount of state credits is limited to a total of $50 million each fiscal year, but unreserved credit allocation and recaptured or disallowed credits may be added to the next fiscal year’s cap. R.C. 175.17 and 175.12. etc.

Motion Picture Tax Credit Cap Increased. The motion picture tax credit’s annual cap is increased to $50 million (the previous cap was $40 million). The Budget Bill provides that $5 million of the $50 million cap must be set aside for Broadway theatrical productions. Any unused amount of the $5 million is to be carried forward to the following year, but is still reserved for Broadway theatrical productions. R.C. 122.85.

Production Company Tax Credit for Capital Improvements. The Budget Bill adds a new tax credit available to production companies that complete qualifying capital improvement projects in Ohio. The credit equals 25% of the amount a production company spends to construct, acquire, repair, or expand facilities that will be used in a motion picture or theatrical production, up to $5 million per project. The total amount of such credits is capped at $25 million each fiscal year and no more than $5 million may be awarded to projects in single county each fiscal year. (However, the Department of Development is given authority to decrease the $25 million cap and allocate the reductions to instead increase the motion picture tax credit cap of $50 million.) The credits may be claimed against the financial institutions tax, individual income tax, and commercial activity tax for the tax year when the certificates are issued. The credits may be transferred one time if notice is provided to the Department of Development. R.C. 122.852.

Job Creation and Job Retention Clawback Provision. The Tax Credit Authority is now permitted to adjust the clawback amount a noncompliant taxpayer must repay from a job creation or job retention agreement one time within 90 days after initially certifying a repayment amount to the Tax Commissioner or the Superintendent of Insurance. R.C. 122.17 & 122.171.

Important Administrative Changes

Changes to Methods for Delivery of Tax Notices Create Significant Risks. For any tax notice currently required to be sent by certified mail, the Budget Bill allows the Tax Commissioner to instead send it by ordinary mail or electronically. It also removes certain recordkeeping requirements a delivery service must meet to be used by the Tax Commissioner to deliver tax notices. These changes were recommended by the Ohio Department of Taxation as a way to reduce its postage costs because approximately 50% – 60% of its certified mail is returned unsigned. R.C. 5703.056 and many other sections.

ZHF Observation: This surprising change opens the door for significant confusion and problems for both the Department of Taxation and taxpayers. It is unfortunate that due process rights of the 40% – 50% of taxpayers that do actually return the certified mail signed will now be at risk of missing an assessment and losing their appeal rights. Also, authorizing tax authorities to use regular mail will increase the potential for fraud against taxpayers. For example, our Firm often receives inquiries from our clients that receive “tax due” notices from nefarious sources.

It is curious that the Department of Taxation and Attorney General supported these changes, which will now make it harder for those government agencies to prove if and when tax assessments were received and, therefore, whether the limited period for appeal has started to run. Of course, this could benefit taxpayers seeking to avoid enforcement and collection efforts—so the change might be good for those taxpayers, but bad for honest taxpayers.

Another concern is that taxpayers may miss filing deadlines because they do not recognize the importance of an assessment that is sent by ordinary mail. Certified mail is a step-above ordinary mail and calls to the taxpayer’s attention that it has received an important government notice. Also, regular mail is simply unreliable. Our Firm recommends that taxpayers never send tax returns or payments by regular mail, but instead use certified mail which shows the returns or payments were sent and received.

Finally, it is also surprising that the General Assembly accepted this idea. Municipalities advocated for ordinary mailing of tax assessments during the H.B. 5 process in 2014. The General Assembly rejected that request because of the problems highlighted above.

Rainy Day Fund Increased. The Budget Stabilization Fund, often referred to as the Rainy Day Fund, is currently funded to 8.5% of the GRF revenues of the preceding fiscal year. The Budget Bill increases that threshold to 10%. R.C. 131.43.

ZHF Observation: In fact, 19 states recently reported rainy day fund thresholds of 15% or more. Ohio policy makers may be considered fortunate during this budget cycle because the state has sufficient revenues to achieve three significant goals: 1) cutting taxes, 2) spending more money, and 3) saving money for future shortfalls. We haven’t seen this type of situation since right before the recession of the early 2000’s.

If you have any questions about how the tax or economic development provisions contained in the Budget Bill may apply to you or your clients, please contact any of our professionals.