The Ohio House of Representatives Finance Committee introduced a substitute biennial budget bill this week, Sub. H.B. 166 (“Bill”). As you will recall, Governor Mike DeWine offered his budget proposal in March of this year. The Governor’s budget proposal called for an increase of $2.8 billion in new spending, to be paid for by a growing Ohio economy.

The Ohio House’s budget proposal builds on the Governor’s proposed new spending by adding an additional $526 million of spending over the biennium, above the Governor’s original proposal. The House is also proposing a mix of tax law changes that have similar results as previous Kasich Administration budget proposals—increasing taxes on businesses and business owners by approximately $423 million and lowering taxes on other individual income by approximately $500 million. While this results in a net revenue decrease of approximately $77 million over the biennium, taxes on businesses and their owners goes up significantly.

The discussion below highlights the House Finance Committee’s tax proposals. The Bill is expected to clear the House late next week and then will go to the Senate for further deliberation.

Personal Income Taxes

Small Business Deduction: In 2013, Ohio’s Republican General Assembly and Administration enacted a new deduction, which exempted the first $250,000 of business income from taxation as an incentive to create jobs and increase Ohio investment. As an additional incentive, beginning in 2015, business income above $250,000 ($125,000 per spouse) was taxed at 3% rather than using the personal income tax tables which imposed a tax rate of 4.997%. Now, the Republican House proposes to cut the deduction by 60%, lowering the maximum deduction to $100,000 (or $50,000 per spouse). Under the current Bill, business income earned above $100,000 would be subject to tax at a rate of 3%. This could result in a tax increase of up to $4,500 per small business owner.

House leadership has indicated that the Bill was intended to include a full repeal of the 3% flat tax rate imposed on business income over $250,000, and instead impose the typical income tax rate of 4.997% for earnings above that level. The House seems intent on amending the Bill to eliminate this treatment, which could result in an additional tax increase of as much as $1.1 billion tax per year for small business owners.

ZHF Observation: In 2013, Ohio began phasing in the Small Business Deduction to spur hiring and investment. The deduction became fully phased in for tax year 2015. Some policy makers have raised concerns that some business owners who benefit from the deduction are not job creators. While the deduction may have applied more broadly than initially anticipated, Ohio’s unemployment has declined from 7% in January 2013 to 4.4% in March 2019. It seems to have worked. In fact, Ohio’s personal income tax generated nearly $350 million more revenue in FY2018 than it did in FY2014 (the first fiscal year to be impacted by the deduction). The House’s proposed change does nothing to actually “fix” the concerns raised by some policy makers that the deduction is not tied to actual job creation and investment; instead, the proposal simply reduces the deduction for all business taxpayers, including the job creators. Speaker Householder has been quoted in press reports as advocating for the elimination of the entire flat rate tax on business income.

New Term of Art – “Modified Adjusted Gross Income” – Impacts Means Tested Credits: Another concern raised by policy makers with regard to the business income deduction is that the mechanism used enables more fortunate taxpayers to inadvertently take advantage of tax credits intended to help less fortunate taxpayers. To address this, the Bill enacts a new definition, “modified adjusted gross income,” which means “Ohio adjusted gross income plus any amount deducted under division (A)(31).” Division (A)(31) is the business income deduction. The impact of the new definition is to require taxpayers that were permitted to deduct business income to nonetheless include that deducted amount in considering whether, and to what extent, the taxpayer is eligible for credits, deductions, or exemptions that are limited by income thresholds. The following credits or deductions are impacted by the new definition:

- The $20 personal exemption credit under R.C. 5747.022;

- The personal exemption deduction under R.C. 5747.025;

- The joint filing credit under R.C. 5747.05(E);

- The credit based on the federal dependent care credit under R.C. 5747.054;

- The retirement income credit under R.C. 5747.055;

- The credit for those ages 65 and over under R.C. 5747.055; and

- The real property tax homestead benefit under R.C. 323.151 and R.C. 323.152.

ZHF Observation: The non-codified law, at Section 757.150, states that the changes to the sections listed above apply to taxable years beginning on or after January 1, 2019 and following (for the income tax provisions) and to tax years 2019 and following (for the real property tax provision). However, the Bill’s amendment to R.C. 5747.025 (the personal exemption deduction) applies the income testing change to certain taxable years that are closed taxable years (taxable years 2018 and prior). The Ohio Constitution prohibits retroactive laws, so these provisions likely need to be clarified.

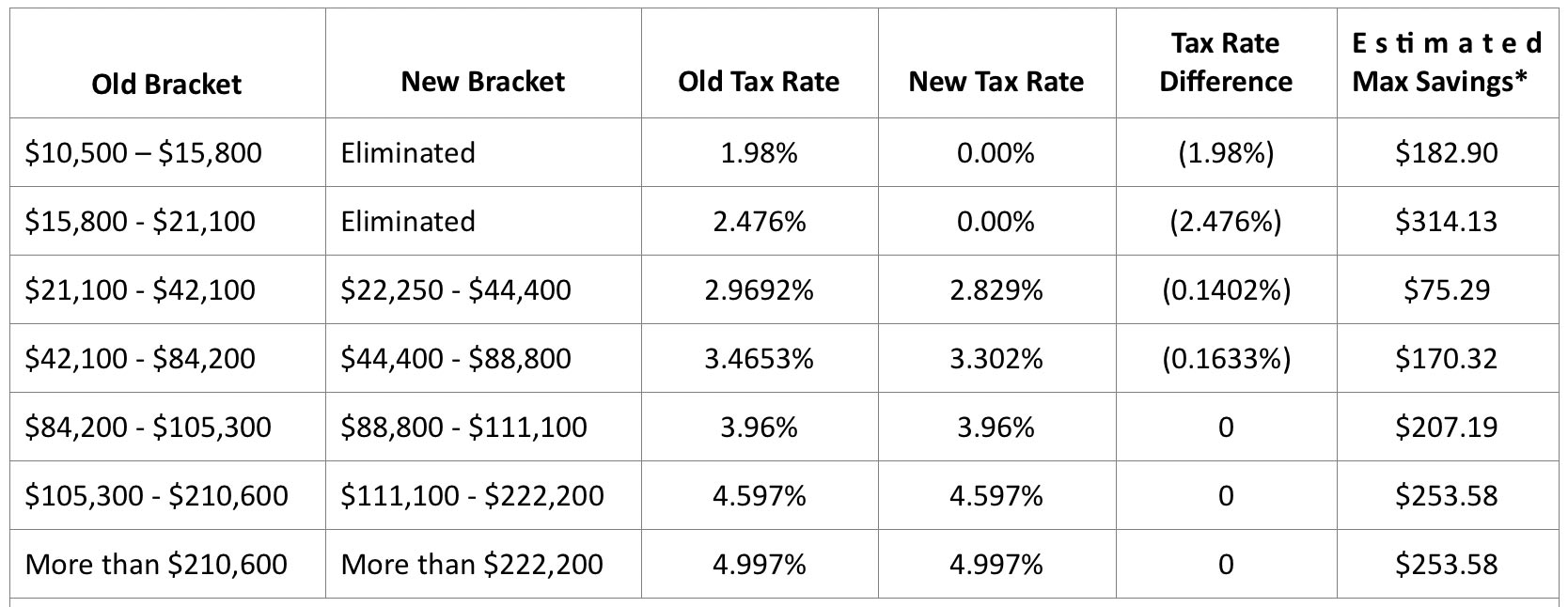

Personal Income Tax Rates (Non-Business Income): The House proposes eliminating the bottom two personal income tax brackets, eliminating all taxes for those individuals with less than $22,250 of Ohio adjusted gross income. The proposal also makes some tweaks to the brackets as follows:

* – Note: The Est. Max Savings assumes a taxpayer makes the highest proposed (new) bracketed amount and compares what that taxpayer would pay under the current bracketed system and the House’s proposed new bracketed system. These amounts cannot be added up. For instance, a taxpayer earning $111,100 will save $207.19, while a taxpayer earning $222,200 or more will save $253.58.

ZHF Observation: In 2017, Ohio removed taxpayers making less than $10,500 from the tax rolls. The House proposes to now remove taxpayers making $22,249 or less. However, under the House plan, taxpayers making one more dollar (i.e., $22,250) must pay tax on their first $22,250.

Personal Income Tax Credits – Some Eliminated, Some Added:

Ohio Opportunity Zone Credit: The Bill retains Governor DeWine’s proposal to provide an Ohio Opportunity Zone Credit, helping to attract investment into Ohio zones.

Lead Abatement Credit: The Governor’s proposed lead abatement credit is also retained by the new House language.

Campaign Contribution Credit: The campaign contribution credit, which allows up to a $50 credit ($100 for joint returns) for contributions to state-level candidates, is eliminated by the Bill.

Ex-Felon Work Opportunity Tax Credit: The House provides a new tax credit for those individuals that hire qualified ex-felons and claim a federal Work Opportunity Tax Credit. The Ohio credit equals 30% of the amount of the federal credit claimed for the tax year. The proposed Ohio credit is not refundable but may be carried forward for seven years.

ZHF Observation: The Ex-Felon WOTC is a positive tax policy, encouraging the employment of ex-felons. However, the credit is only available to income taxpayers and not CAT taxpayers. As a result, regular corporations (which include most medium to large sized businesses) cannot benefit from the incentive to hire ex-felons, which may seriously frustrate the purpose of the credit.

Sales and Use Tax

Remote Sellers – Wayfair Standards Proposed:

The Bill adds two more activities that create substantial nexus for a seller, which fall in line with the nexus standards allowed in the Wayfair decision:

• Having gross receipts in excess of $100,000 (in the current or preceding calendar year) from selling tangible personal property or providing services the benefit of which is realized in Ohio; and

• Engaging in 200 or more separate transactions (in the current or preceding calendar year) selling tangible personal property or providing services the benefit of which is realized in Ohio.

The Bill also eliminates three activities that create substantial nexus for a seller:

• Entering into an agreement with Ohio residents that for a commission or fee refer potential customers to the seller (assuming cumulative gross receipts referred to the seller exceeded $10,000 during the preceding twelve months);

• Using in-state software to sell or lease tangible personal property or services providing the seller had gross receipts in excess of $500,000 in the current or preceding calendar year; and

• Entering into agreements with another person to provide a content distribution network in Ohio to accelerate or enhance the delivery of the seller’s website provided the seller had gross receipts in excess of $500,000 in the current or preceding calendar year

The Bill adds a “marketplace facilitator” to the definition of seller, thus requiring a marketplace facilitator (i.e., Amazon.com, eBay, Walmart.com, etc.) to collect seller’s use tax on sales facilitated by the marketplace facilitator on behalf of one or more marketplace sellers, assuming the marketplace facilitator has substantial nexus. Marketplace facilitators are presumed to have substantial nexus if they meet the thresholds described above with respect to their own sales and transactions, plus those the sales and transactions facilitated on behalf of all their marketplace sellers.

The Bill excludes lodging by a hotel from the definition of sales facilitated by a marketplace facilitator.

ZHF Observation: Interestingly, the sale of digital goods is arguably not addressed by these new nexus provisions as digital goods are neither tangible personal property nor a service.

ZHF Observation: The former Kasich Administration seemed hesitant to impose an economic nexus/Wayfair standard because it is considered by many to be a tax increase on Ohioans. But, most Ohio remote sellers are burdened by similar standards in other states. Ohio’s proposed standard will fall in line with 31 other states that use the same standard including the surrounding states of Indiana, Kentucky, Michigan, Pennsylvania and West Virginia. Ohio’s proposed threshold seems a bit aggressive compared to the significantly higher CAT nexus threshold of $500,000 of sales. Businesses should be aware that Wayfair could have an impact on the standard applied to nexus as it relates to the CAT and the $500,000 threshold could be at risk.

Situsing Marketplace Sales: The Bill also provides a situsing hierarchy for marketplace facilitators to determine the proper jurisdiction for which to collect the tax. Marketplace facilitators would be treated in all respects as a seller except for being relieved from liability if the marketplace seller provides incorrect information about the sale. In that case, the marketplace seller is liable for the tax. Marketplace sellers are not liable for any sales tax related to sales facilitated by a marketplace facilitator that is treated as a seller (i.e., has substantial nexus) and the Ohio Department of Taxation (“ODT”) is prohibited from auditing a marketplace seller for sales facilitated by a marketplace facilitator.

Tax Imposed on Uber and Lyft Type Services: The Bill imposes the sales tax on transportation services, which, on its face, seems to expand the previous taxable service of intrastate transportation of persons by motor vehicle or aircraft to include transportation network company services provided by transportation network companies, such as Uber and Lyft. The Bill requires transportation network companies to collect sales tax on transportation network company services instead of the transportation network company driver. The definition of “price” was also amended to exclude any additional fees paid by the rider for transportation network company services, such as airport access fees, booking fees, tolls, and any other services not related to the transportation service.

ZHF Observation: Because they are transporting persons, this type of service is currently taxable. The challenge has been determining who is responsible for collecting the sales tax—the driver (who is an independent contractor) or the network company (who collects the fees). This provision makes clear that the network company will be responsible for collecting the tax.

Manufacturing Exemption Expanded: The House proposal adds a sales and use tax exemption (R.C. 5739.011(B)(14)) for equipment, supplies and building and janitorial services used to clean or maintain any tangible personal property, machinery, or equipment that is used primarily in a continuous manufacturing operation. It also expands the exemption (R.C. 5739.011(B)(13)) for equipment and supplies used to clean processing equipment from only milk, ice cream, yogurt, cheese and similar dairy products to “food” (as defined in R.C. 3717.01). This definition of food is broader than the definition found in R.C. 5739.01(EEE).

ZHF Observation: It would appear that if (B)(14) remains in the Bill, (B)(13) would not be necessary as (B)(14) would seem to exempt the same items currently covered by (B)(13).

Several Exemptions Eliminated: The Bill also eliminates several sales and use tax exemptions, including:

• Sales of vehicles, repair services, and parts to a professional racing team;

• Sales of investment metal bullion and investment coins;

• Sales of replacement and modification parts for engines and parts, as well as repair services, of aircraft used primarily in fractional aircraft ownership programs;

• Sales of materials, parts, equipment, and engines used to repair or maintain aircraft or avionics systems of aircraft, including repair and maintenance services of aircraft; and

• Sales of full flight simulators that are used for pilot or crew training.

Cap on Sale of Fractional Share Aircraft Eliminated: The Bill also proposes to eliminate the maximum tax of $800 on the sale of aircraft used in a fractional aircraft ownership program.

ZHF Observation: Imposing sales tax on repair and maintenance services of highly mobile property will generally result in those services (and related parts) being provided in other states that continue to provide such exemptions. Similarly, eliminating the $800 cap on the sale of fractional program aircraft, which are almost always on the go, will simply mean fractional companies will wait to finalize their sales until the aircraft is sitting in more tax friendly states (or over international waters).

Real Property Tax

The House language proposes to expand the real estate tax exemption that is currently available for veterans and fraternal organizations. Under current law, a real estate tax exemption applies to their facilities so long as they do not receive more than $36,000 in rent. The language provides that when measuring the $36,000 threshold, rents received from other fraternal organizations for their use or to provide, on a not-for-profit basis, educational or health services are not included in the measurement.

ZHF Observation: The Legislative Service Commission acknowledges that this provision would decrease revenues to schools and other units of local government, but also increase real property taxes of other property owners for levies designed to raise fixed sums of money.

Pass-Through Entity Tax

The Bill proposes to reduce the withholding rate for the Pass-Through Entity (PTE) Tax to 3% for all investors for taxable years beginning on and after January 1, 2019. The revised withholding rate of 3% matches the flat 3% rate on taxable business income and is a positive change that will eliminate much of the over-withholding that has resulted over the last several years following the enactment of the flat 3% rate on taxable business income. Because the PTE Tax acts as an enforcement mechanism for collecting the ultimate income tax due from the PTE’s investors, this change more appropriately withholds tax at the proper tax rate.

ZHF Observation: As discussed above, the House has indicated it intends to also eliminate the 3% flat tax rate on business income. As a result, this withholding percentage might change to better reflect the resulting higher tax rate.

The Bill also allows a PTE, beginning in taxable years beginning on and after January 1, 2019, to avoid the PTE withholding tax altogether with respect to any PTE investor that agrees to be subject to the Ohio income tax on the investor’s share of the Ohio-sourced income from that PTE and agrees to make a good faith and reasonable effort to comply fully and timely with the Ohio income tax filing responsibilities of that investor. This change effectively allows the PTE and its investors to consider the impact of the business income deduction that is only permitted to be claimed on a personal income tax return. The current law effectively requires tax to be withheld by the PTE, even where much, if not all, of that tax could be refunded to an investor that files a personal income tax return and claims the benefit of the business income tax deduction and other credits and deductions. The impact on the PTE is also positive since the PTE can now avoid the cash-flow issue of paying a tax that will ultimately be refunded to the investors.

ZHF Observation: The withholding rate reduction is long overdue and is a positive step towards simplifying and streamlining the PTE tax structure’s interaction with the personal income tax. The ability for the investors to file statements to avoid tax being withheld by the PTE is also a positive step, but ODT will have to keep a keen eye on the enforcement of the PTE investors’ tax filings. If this law is enacted, the PTE should immediately review its estimated payment process, because the new law would immediately affect how much the PTE is required to pay into ODT for estimated payments due with respect to the current tax year.

Partnership Audit and Assessment Procedures

The Bill contains provisions to adopt the changes in how the Internal Revenue Service (“IRS”) will audit some entities taxed as partnerships. Historically, the IRS would audit such entities at the partner level resulting in a very low level of partnership activity being audited. The Internal Revenue Code was changed to allow the taxation of partnerships, similar to corporations, particularly large partnerships. The federal rules are complex and allow alternative options for auditing and reporting federal adjustments in certain factual situations. The proposed changes to adopt these same provisions for Ohio purposes follow closely the Model Uniform Statute and Regulation for Reporting Adjustments to Federal Taxable Income and Federal Partnership Audit Adjustments (the “Model Uniform Reporting Statute”). The Model Uniform Reporting Statute was approved by the Multistate Tax Commission (“MTC”) Uniformity Committee on July 24, 2018 for referral to the MTC Executive Committee.

Financial Institutions Tax

The Financial Institution Tax (FIT) is imposed on financial institutions (banks and their related entities) in lieu of other taxes, such as the Commercial Activity Tax. FIT is based on a financial institution’s total equity. The Bill limits the amount of equity subjected to tax by providing a cap, exempting equity in excess of 14% of a financial institution’s total assets from the FIT base.

Conclusion

The House’s Bill is reminiscent of previous Kasich Administration budget proposals to lower overall personal income taxes by increasing taxes on businesses and job creators. Without the House’s proposal to fund an additional $526 million of spending over the biennium, the increase in business taxes would not be necessary. The House has also announced a desire to increase taxes on small businesses even further by eliminating the 3% flat rate on business income over $250,000—which could result in an additional $1.1 billion annual tax increase on small business owners (and could mean that the current Bill is out of balance or even more spending is expected). While the House will likely move quickly next week to enact its budget proposal, there is still time to push back against changes that will negatively impact your business. Further, the Bill will go to the Senate next, offering another venue to mitigate the negative impacts of the House version of the Bill.

If you would like to learn more about ways to address your concerns, please do not hesitate to contact a Zaino Hall & Farrin professional.