Although nearly three weeks late, Ohio has finally adopted a biennial budget, Am. Sub. H.B. 166 (“the Budget Bill” or “Bill”). Even though Ohio’s House, Senate, and Governor are controlled by Republicans, they had a very hard time agreeing with each other on anything except to dramatically increase spending and impose higher taxes on lawyers and lobbyists. For a complete discussion of Am. Sub. H.B. 166’s spending and other non-tax provisions, please see ZHF Consulting LLC’s Budget Buzz.

Background

Governor Mike DeWine introduced his first biennial budget on March 25, 2019. While his budget proposal asked for significant spending increases over prior years, it did not contain any significant tax policy changes.

House of Representatives: On May 9, 2019, the Ohio House of Representatives passed its version of the Budget Bill and added an additional $664 million of All Funds spending over the Governor’s All Funds spending proposal. The House also proposed a mix of major tax policy changes that had similar results as previous Kasich Administration budget proposals—increasing taxes on businesses and business owners by approximately $1.2 billion while cutting income tax rates across-the-board by 6.6%. While this would have resulted in a net revenue decrease overall, taxes on businesses and their owners would increase significantly under the proposal. The most impactful change was the reduction of the $250,000 business income deduction down to $100,000 and the retroactive elimination of the 3% flat tax rate on business income for all of 2019, resulting in a direct tax increase on Ohio businesses and job creators of over $1 billion over the biennium. In exchange, the House proposed an across-the-board income tax cut of 6.6% for all Ohioans.

Senate: On June 20, 2019, the Ohio Senate adopted its version of the Budget Bill. The Senate increased All Funds spending by nearly $330 million over the House spending plan, but walked back several of the House’s tax policy changes. For instance, the Senate proposed reinstating the full $250,000 business income deduction and delayed the elimination of the 3% flat tax rate until 2020. The Senate also included an across-the-board income tax cut of only 4% in 2019 and another 4% in 2020. The Senate did come to the rescue of some special Ohio industries by reinstating several sales and use tax exemptions and other credits for the fractional interest aircraft industry, the motion picture industry, and hotel intermediary industry. The Senate also added a new tax on vapor products, as well as a clarification of the municipal income tax treatment of certain supplemental executive retirement plans.

Conference Committee: After the Senate passed its version of the budget, the Bill went to Conference Committee. The Conference Committee made no progress on reconciling the House and Senate budget proposals by the June 30, 2019 deadline. Therefore, the General Assembly enacted a temporary 17 day appropriation bill to keep Ohio’s government functioning. The Conference Committee reported out its compromise budget on July 16, 2019, and the final Bill was approved by the House and Senate on July 17, 2019. The Conference Committee further increased All Funds spending by over $1.4 billion, compared to the Senate version of the budget. As a result, the Bill increases All Funds spending by over $9.5 billion compared to 2019 flat line spending levels and increases General Revenue Fund spending by nearly $4.8 billion compared to 2019 flat line spending levels.

Governor’s Signature and Line Item Vetoes: Governor Mike DeWine signed the Bill on July 18, 2019 and issued twenty five line item vetoes, five of which relate to tax provisions. Governor DeWine did not veto the increased taxes imposed on law firms, lobbying firms, and any other businesses that have in-house attorneys or lobbyists, including manufacturers, retailers, accountants, and other service providers.

The Bill adopts the following major tax law changes.

Personal Income Taxes

Business Income Deduction & 3% Flat Rate: Effective for tax year 2020, the Bill limits the availability of the business income deduction and 3% flat income tax rate (collectively referred to herein as “the BID”). Under the language, the BID applies to “eligible business income.” “Eligible business income” is defined to mean business income excluding income from a trade or business that performs either or both of the following:

(a) Legal services provided by an active attorney admitted to the practice of law in this state or by an attorney registered for corporate counsel status under section 6 of rule VI of the Ohio supreme court rules for the government of the bar of Ohio;

(b) Executive agency lobbying activity, retirement system lobbying activity, or actively advocating by a person required to register with the joint legislative ethics committee under section 101.78, 101.92, or 121.62 of the Revised Code.

Nothing in the statutory language requires that the primary activity of the trade or business be the provision of legal or lobbying services, or that it derives income from such activity.

ZHF Observation: This legislative language was hastily drafted and raises serious tax policy problems and constitutional issues. While it is our understanding that the limitation was intended to only impact law firms and lobbying firms, the language has a much broader application and eliminates the BID for any businesses that has in-house legal counsel or uses a lobbyist, including manufacturers, retailers, accountants, and other service providers.

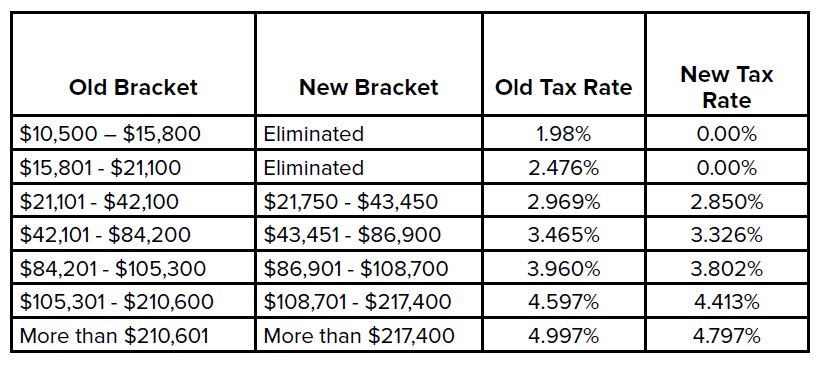

Across-the-Board Income Tax Rate Cut: The Bill eliminates the bottom two brackets of the income tax and provides an across-the-board personal income tax rate reduction of 4%, effective for tax year 2019.

The following chart illustrates the differences between the old brackets and the new brackets.

ZHF Observation: In 2017, Ohio removed taxpayers making less than $10,500 from the tax rolls. The Bill now removes taxpayers making not more than $21,750. However, taxpayers in that income range need to watch out—a taxpayer making $21,750 pays $0.00, while another taxpayer earning one extra dollar (i.e., $21,751) pays $310.47—now that’s a hefty marginal rate!

Ohio Political Party Income Tax Checkoff: The Bill eliminates this checkoff beginning with taxable year 2019 (i.e., for tax returns filed in 2020).

Political Campaign Contributions Tax Credit: The Bill eliminate this credit beginning with taxable year 2019.

PTE Financial Institutions Tax Credit: The Bill repeals the credit formerly authorized under R.C. 5747.65 beginning in taxable year 2019.

Lead Abatement Tax Credit: The Governor’s proposed lead abatement credit is retained by the Bill, but doubles the cap on the credit, increasing it from $5 million over the two year biennium to $5 million per year. The Lead Abatement Tax Credit allows an individual to obtain a nonrefundable tax credit equal to the lesser of the lead abatement costs incurred by a taxpayer on an eligible dwelling during the tax year, the lead abatement costs listed on the application, or $10,000.

New Term – “Modified Adjusted Gross Income” – Impacts Means Tested Credits: Another concern raised by policy makers with regard to the business income deduction is that the mechanism used enables more fortunate taxpayers to inadvertently take advantage of tax credits intended to help less fortunate taxpayers. To address this, the Bill enacts a new definition, “modified adjusted gross income,” which means “Ohio adjusted gross income plus any amount deducted under division (A)(31).” Division (A)(31) is the business income deduction. The impact of the new definition is to require taxpayers that were permitted to deduct business income to nonetheless include that deducted amount in considering whether, and to what extent, the taxpayer is eligible for credits, deductions, or exemptions that are limited by income thresholds. The following credits or deductions are impacted by the new definition:

- The $20 personal exemption credit under R.C. 5747.022;

- The personal exemption deduction under R.C. 5747.025;

- The joint filing credit under R.C. 5747.05(E);

- The credit based on the federal dependent care credit under R.C. 5747.054;

- The retirement income credit under R.C. 5747.055;

- The credit for those ages 65 and over under R.C. 5747.055; and

- The real property tax homestead benefit under R.C. 323.151 and R.C. 323.152.

Sales and Use Tax

Ohio Nexus Standards: The nexus standards for Ohio sales and use tax purposes are now changed beginning on August 1, 2019, adding two more activities (greater than $100,000 in gross receipts, 200 or more transactions) that create substantial nexus for a seller, which fall in line with the nexus standards allowed in the U.S. Supreme Court’s Wayfair decision.

The Bill also eliminates three activities (click through nexus, in-state software and content distribution network) that create substantial nexus for a seller.

ZHF Observation: Interestingly, the sale of digital goods is arguably not addressed by these new nexus provisions as digital goods are neither tangible personal property nor a service. Further, some definitions may need refined because tax may need to be collected by unintended service providers that do not have the information required to comply with the new changes.

ZHF Observation: The former Kasich Administration seemed hesitant to impose an economic nexus/Wayfair standard because it is considered by many to be a tax increase on Ohioans. But, most Ohio-based remote sellers are burdened by similar standards in other states. Ohio’s proposed standard will fall in line with 31 other states that use the same standard including the surrounding states of Indiana, Kentucky, Michigan, Pennsylvania and West Virginia. The Bill’s proposed threshold seems a bit aggressive compared to the significantly higher CAT nexus threshold of $500,000 of sales. Businesses should be aware that Wayfair could have an impact on the standard applied to nexus as it relates to the CAT and the $500,000 threshold could now be at risk of being lowered.

Marketplace Facilitators: The Bill adds “marketplace facilitator” to the definition of seller, thus requiring a marketplace facilitator (i.e., Amazon.com, eBay, Walmart.com, etc.) to collect seller’s use tax on sales facilitated by the marketplace facilitator on behalf of one or more marketplace sellers, assuming the marketplace facilitator has substantial nexus. The Bill also:

- Specifies that a person providing only advertising services is not a marketplace facilitator; and

- Eliminates charging, collecting, or receiving selling fees, listing fees, referral fees, closing fees, or other consideration from the facilitation of a sale as elements that may contribute to the determination that a sale is “facilitated” by a marketplace facilitator.

The Bill provides that marketplace facilitators are treated in all respects as a seller except for being relieved from liability if the marketplace seller provides insufficient or incorrect information about the sale. In that case, the marketplace seller is liable for the tax. Marketplace sellers will not be liable for any sales tax related to sales facilitated by a marketplace facilitator that is treated as a seller (i.e., has substantial nexus) and the Ohio Department of Taxation (“ODT”) is prohibited from auditing a marketplace seller for sales facilitated by a marketplace facilitator.

If a marketplace seller applies for and meets certain conditions, the Tax Commissioner is required to waive the requirement for a marketplace facilitator to collect and remit sales tax as it relates to that specific marketplace seller. The marketplace seller will be required to collect and remit the tax once the waiver is obtained.

ZHF Observation: The language is a bit vague and a position exists that in-state marketplace facilitators are not subject to the requirements imposed on non-Ohio marketplace facilitators. Of course, this also raises some Constitutional issues.

Manufacturing Exemption Expanded: The Bill expands the exemption for equipment and supplies used to clean processing equipment from only milk, ice cream, yogurt, cheese and similar dairy products to “food.” R.C. 3717.01’s definition of food is used for purposes of this exemption, which is broader than the definition found in R.C. 5739.01(EEE).

Two Sales & Use Tax Exemptions Eliminated: The Bill eliminates two sales and use tax exemptions:

- Sales of vehicles, repair services, and parts to a professional racing team; and

- Sales of investment metal bullion and investment coins.

Vapor Products Tax

Beginning October 1, 2019, the Bill enacts a new tax on vapor products. The tax equals $0.10 per milliliter of vapor product, which includes any liquid solution or other substance that contains nicotine and is depleted as it is used in an electronic smoking product. The Bill also establishes new licensing requirements for retail dealers of vapor products.

Beginning in July 2020, vapor product importers and manufacturers are required to register with the Tax Commissioner and provide monthly reports listing sales of vapor products.

ZHF Observation: In addition to tax law requirements, the new law also imposes many new regulatory requirements. Any member of the industry should carefully examine the new law’s language to ensure proper compliance.

Financial Institutions Tax

The Financial Institution Tax (FIT) is imposed on financial institutions (banks and their related entities) in lieu of other taxes, such as the Commercial Activity Tax. FIT is based on a financial institution’s total equity. The Bill limits the amount of equity subjected to tax by providing a cap, exempting total equity capital in excess of 14% of a financial institution’s total assets from the FIT base. The limitation is applied before determining the amount of total equity capital apportioned to Ohio.

Real Property Tax

Property Tax Bill Detail: The Bill requires that each county auditor and treasurer shall post on their respective websites, or the website of the county, the percentage of property taxes charged by each taxing unit, and in the case of the county as a taxing unit, the percentage of taxes charged by the county for each of the county purposes for which taxes are charged. This requirement goes into effect on January 1, 2021.

Expanded Exemption for Veteran and Fraternal Organizations: The Bill expands the real property tax exemption that is currently available for veterans and fraternal organizations. Under current law, a real property tax exemption applies to their facilities so long as they do not receive more than $36,000 in rent. The Bill provides that when measuring the $36,000 threshold, rents received by a fraternal organization from another fraternal organization for its use or to provide, on a not-for-profit basis, educational or health services are not included in the measurement, nor is the rent arising from renting the real property to another qualified veteran’s organization.

ZHF Observation: The Legislative Service Commission acknowledges that this provision would decrease revenues to schools and other units of local government, but also increase real property taxes of other property owners for levies designed to raise fixed sums of money.

Property tax homestead exemption: The Bill modifies the eligibility for the homestead exemption by requiring deducted “business income” to be included in the income eligibility calculation. This change first applies to tax year 2020 for traditional homes and to tax year 2021 for manufactured homes.

Community Schools Real Property Tax Exemption: The Bill modifies the mechanism for community schools to continue to benefit from a real property tax exemption for tax years following the tax year for which the real property tax exemption was initially granted. The practical effect of this provision is to eliminate the need for the community schools to re-file an application for exemption every tax year, and instead allows the community school to provide a more simplified statement to the tax commissioner attesting that the property still qualifies for the exemption.

Qualified Energy Projects – Tax Exemption: The Bill extends by two years, from December 31, 2020 to December 31, 2022, the deadline by which the owner or lessee of a qualified renewable energy project may apply for a property tax exemption. The Bill also clarifies the calculation of payment in lieu of taxes (PILOT) paid by solar energy projects that receive the exemption.

Economic Development

Opportunity Zone Tax Credit: The Bill retains Governor DeWine’s proposal to provide an Ohio Opportunity Zone Credit, helping to attract investment into Ohio zones. The Bill also allows credits to be transferred one time, only allows the credit once the investment is actually invested into the zone property, and increases the share of fund assets required to be invested from 90% (as with the federal credit) to 100%.

Motion Picture Tax Credit: The Motion Picture tax credit was retained by the Bill and expanded eligible projects to include Broadway theatrical productions. Eligibility for the credit was extended to companies involved in motion picture production but that are not themselves production companies. The Bill also adds a requirement that companies be registered with the Secretary of State in order to receive the credit, changes the process for granting such credits, and eliminates the ability to transfer the credit to others.

Municipal Income Tax – Pensions

The Bill defined the terms of pension and retirement benefit plans for purposes of the exemption from the municipal taxable income. Effective for taxable years beginning on or after January 1, 2020, pensions will include all retirement benefit plans, whether or not the plan qualifies for federal income tax deferment or exemption from FICA or Medicare taxes.

ZHF Observation: The term “pension” was purposely left undefined under Sub. H.B. 5 of the 130th General Assembly, effective January 1, 2016, which enacted significant changes to Ohio’s municipal income tax, because of court cases that were pending and undecided. At that time, it was conveyed to the policymakers that Ohio municipalities would follow the Supreme Court of Ohio’s ultimate determination on the issue. However, after the Ohio Supreme Court determined the certain Supplemental Executive Retirement Plans were “pensions” for purposes of the exemption, several municipalities nonetheless enacted conflicting definitions of the term “pensions.” Now, taxpayers have certainty as to what qualifies as a pension for purposes of the exemption.

New Requirements for Paid Tax Return Preparers

The Bill adopts certain prohibitions for tax return preparers that are not accountants or attorneys, including the following:

(1) Recklessly, willfully, or unreasonably understating the taxpayer’s tax liability;

(2) Failing to properly file returns or keep records;

(3) Failing to cooperate with the Tax Commissioner or comply with tax law;

(4) Failing to act diligently to determine a taxpayer’s eligibility for tax reductions;

(5) Misrepresenting the preparer’s experience or credentials;

(6) Guaranteeing tax refunds or credits; and

(7) Engaging in other fraudulent and deceptive conduct.

ZHF Observation: To be clear, we do not believe this language authorizes CPAs or attorneys to engage in any of these types of behaviors.

The Bill also authorizes the Tax Commissioner to impose a penalty or request that the Attorney General seek an injunction restraining further conduct or, if the conduct is continuous or repeated, restrain the preparer from preparing tax returns. Beginning in 2020, the Commissioner may also require a return preparer to include the preparer’s federal tax identification number on any state tax form he or she prepares, and authorizes the Commissioner to penalize a preparer that fails to do so.

Partnership Audit and Assessment Procedures

The Bill contains provisions to adopt the changes in how the Internal Revenue Service (“IRS”) will audit some entities taxed as partnerships. Historically, the IRS would audit such entities at the partner level resulting in a very low level of partnership activity being audited. The Internal Revenue Code was changed to allow the taxation of partnerships, similar to corporations, particularly large partnerships. The federal rules are complex and allow alternative options for auditing and reporting federal adjustments in certain factual situations. The Bill adopts provisions to incorporate the Ohio impact of the change in the IRS’s audit of some partnerships. The Bill contains substantially similar provisions to language proposed in the Model Uniform Statute and Regulation for Reporting Adjustments to Federal Taxable Income and Federal Partnership Audit Adjustments (the “Model Uniform Reporting Statute”). The Model Uniform Reporting Statute was approved by the Multistate Tax Commission (“MTC”) Uniformity Committee on July 24, 2018 for referral to the MTC Executive Committee. The provisions prescribe procedures for entities taxed as partnership and their investors to file amended Ohio income tax returns to report federal adjustments implemented at the partnership level, including how those investors or entities pay any resulting Ohio tax or request a resulting Ohio refund.

Governor DeWine Line Item Veto

Governor DeWine has line-item veto authority when signing budget bills. The governor exercised twenty five vetoes, of which five are related to tax provisions. The vetoed provisions are briefly described below:

- Centralized Collection Taxpayers: The Bill would have authorized taxpayers who initially opted into the centralized collection system administered by the Ohio tax commissioner to be able to opt out at any time during the initial 24 months of the election by providing sixty day notice to the tax commissioner.

- Transportation Network Companies: The Bill had a provision intended to merely clarify that under current law transportation network companies are required to collect and remit sales tax. After being unable to agree on language, both chambers agreed that this provision was to be removed in Conference Committee; however, because the amendments to the Bill were so hastily constructed, the amendment did not achieve that result–so the Governor helped out the General Assembly by issuing this veto.

- Pre-Residential Development Property: The Bill would have required that property subdivided into residential units be valued at a rate other than market value.

- Property Tax Reductions: The Bill provided a property tax reduction for a subset of people within a school district based upon a formula.

- Property Tax Ballot Language: The Bill required changes to property tax ballot language, to ensure that the levy’s financial impact on the voters would be clearer. For example, it would have required that the tax be stated in terms of so many dollars per hundred thousand dollars of fair market value, instead of per $100 of taxable value.

Conclusion

While most small business taxpayers can take a breath following this rough budget bill process, many business owners still face significant risk that the business income deduction and 3% flat tax rate may no longer apply to them. Because those provisions do not go into effect until tax year 2020, these businesses have some time to address this concern. Such businesses may need to consider eliminating in-house legal counsel and lobbyists by December 31, 2019 in order to avoid losing the BID in 2020.

If you would like to further discuss how any of the Budget Bill’s changes may impact your business, do not hesitate to contact me or any other Zaino Hall & Farrin professional.